SHY (iShares 1-3 Year Treasury Bond ETF)

| name | SHY (iShares 1-3 Year Treasury Bond ETF) |

| type | Bond ETF |

| index | ICE U.S. Treasury 1-3 Year Bond Index |

| mkt cap | N/A |

| style | Short-Term |

The fund will invest at least 80% of its assets in the component securities of the underlying index and it will invest at least 90% of its assets in U.S. Treasury securities that BFA believes will help the fund track the underlying index. The underlying index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to one year and less than three years.

| Lifetime Return | Start Date | End Date |

|---|---|---|

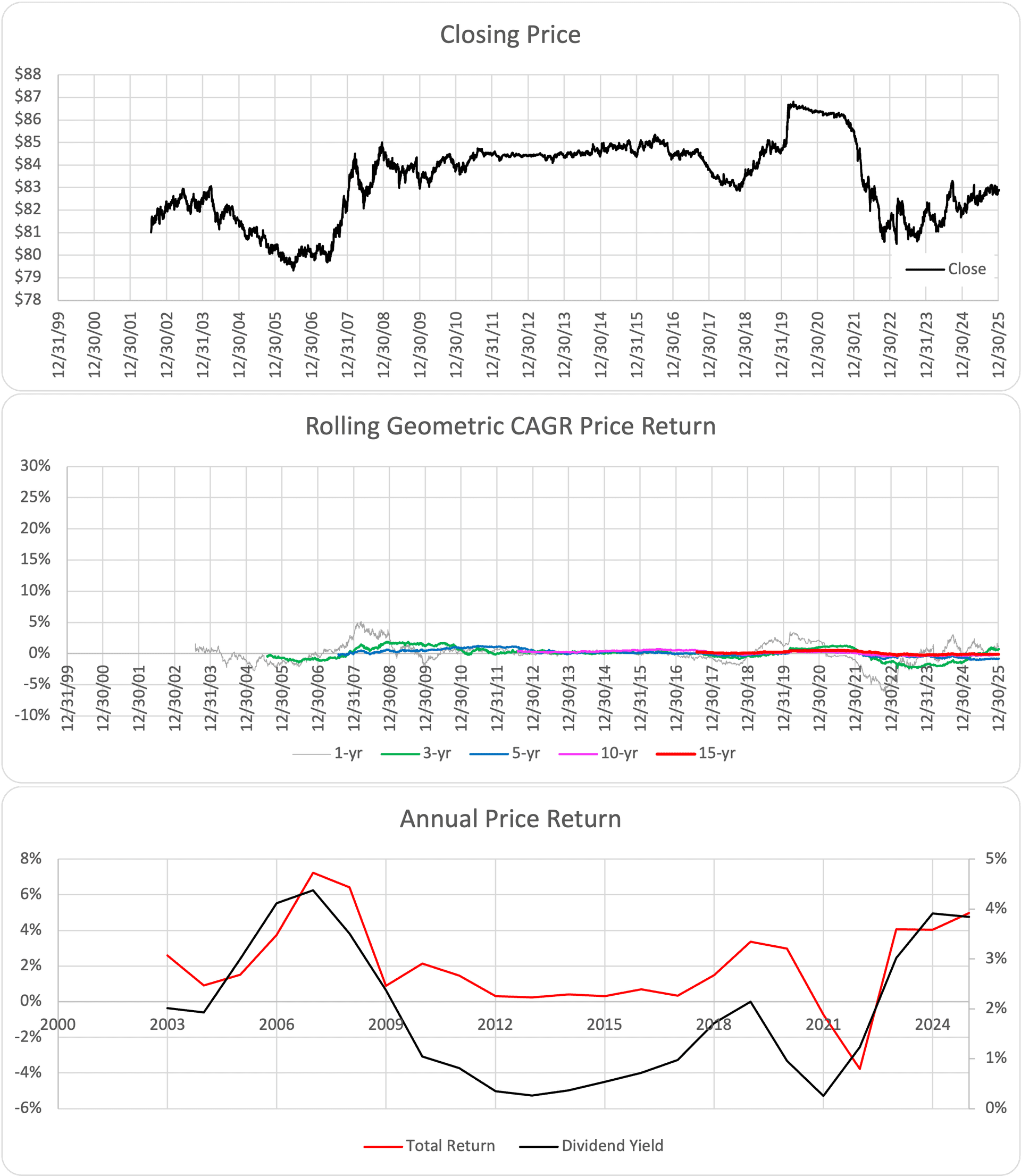

| Dates | 7/30/02 | 1/5/26 |

| Close Price | $81.01 | $82.89 |

| Adj. Price | $52.08 | $82.89 |

| # of Years | 23.4 | |

| Lifetime Price Return | 0.10% | |

| Lifetime Total Return | 2.00% | |

| Annual Return | Price Return | Total Return |

|---|---|---|

| Avg Annual Arithmetic Return | 0.10% | 2.00% |

| Geometric CAGR | 0.10% | 2.00% |

| % Positive Years | 48% | 91% |

| Avg Annual Dividend Yield | 1.90% | |

| Rolling Returns | 1-Yr | 3-Yr | 5-Yr | 10-Yr | 15-Yr |

|---|---|---|---|---|---|

| Avg Geometric CAGR-Price | 0.00% | 0.00% | 0.10% | 0.10% | 0.10% |

| Avg Geometric CAGR-Total | 1.90% | 1.80% | 1.80% | 1.50% | 1.60% |

| % Pos. Days-Price Return | 55% | 58% | 65% | 65% | 62% |

| % Pos. Days-Total Return | 88% | 91% | 100% | 100% | 100% |

Last Updated: January 5, 2026