XLP (Consumer Staples Select Sector SPDR Fund)

| name | XLP (Consumer Staples Select Sector SPDR Fund) |

| type | Stock ETF |

| index | Consumer Staples Select Sector Index |

| mkt cap | Large Cap |

| style | Blend |

In seeking to track the performance of the index, the fund employs a replication strategy. It generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index. The index includes companies that have been identified as Consumer Staples companies by the GICS®. It is non-diversified.

| Lifetime Return | Start Date | End Date |

|---|---|---|

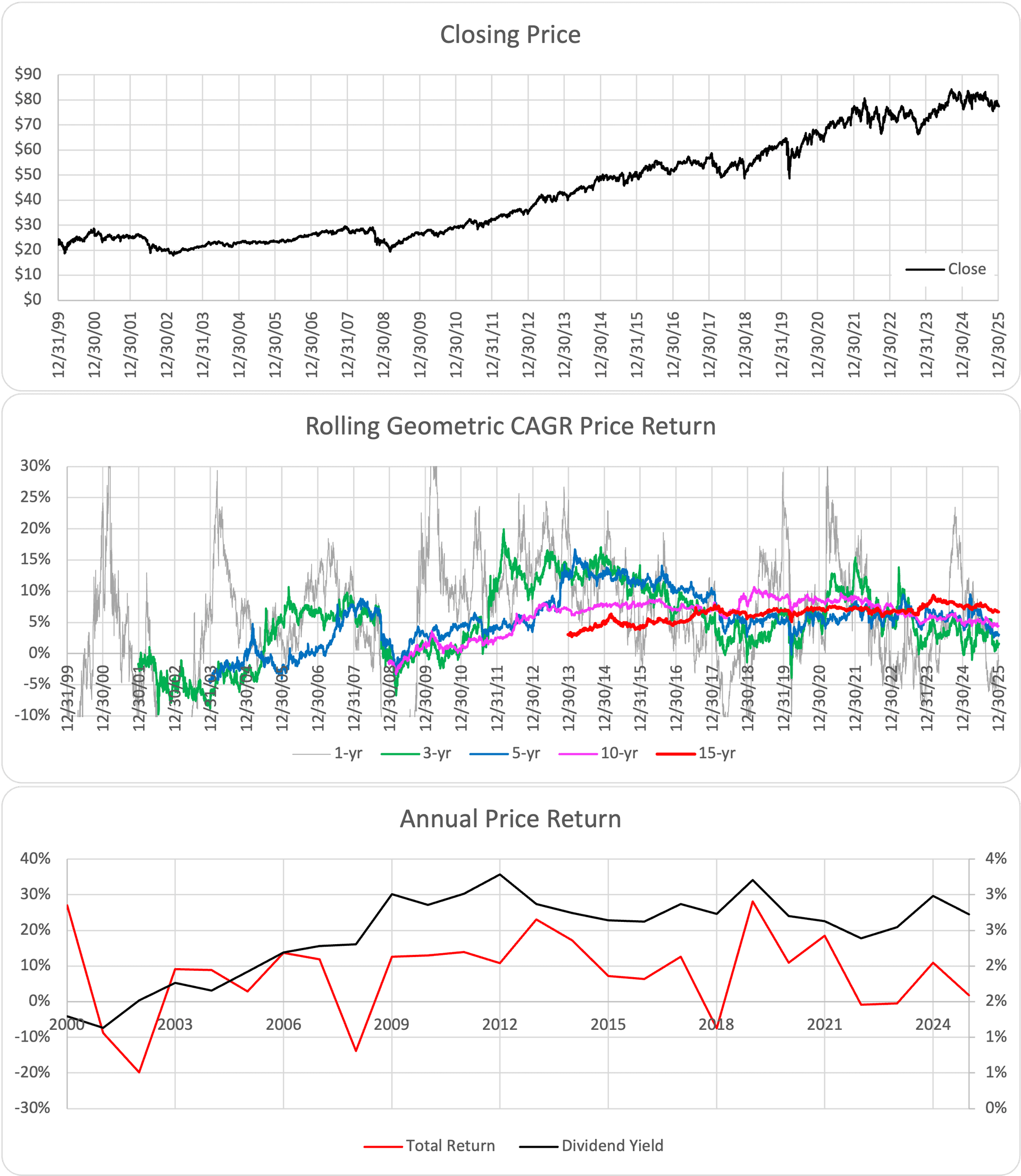

| Dates | 12/22/98 | 1/5/26 |

| Close Price | $26.50 | $77.43 |

| Adj. Price | $14.06 | $77.43 |

| # of Years | 27 | |

| Lifetime Price Return | 4.00% | |

| Lifetime Total Return | 6.50% | |

| Annual Return | Price Return | Total Return |

|---|---|---|

| Avg Annual Arithmetic Return | 4.80% | 7.30% |

| Geometric CAGR | 4.10% | 6.50% |

| % Positive Years | 70% | 74% |

| Avg Annual Dividend Yield | 2.40% | |

| Rolling Returns | 1-Yr | 3-Yr | 5-Yr | 10-Yr | 15-Yr |

|---|---|---|---|---|---|

| Avg Geometric CAGR-Price | 5.10% | 5.00% | 5.50% | 6.00% | 6.40% |

| Avg Geometric CAGR-Total | 7.60% | 7.50% | 8.10% | 8.70% | 9.10% |

| % Pos. Days-Price Return | 75% | 80% | 88% | 96% | 100% |

| % Pos. Days-Total Return | 81% | 86% | 94% | 99% | 100% |

Last Updated: January 5, 2026